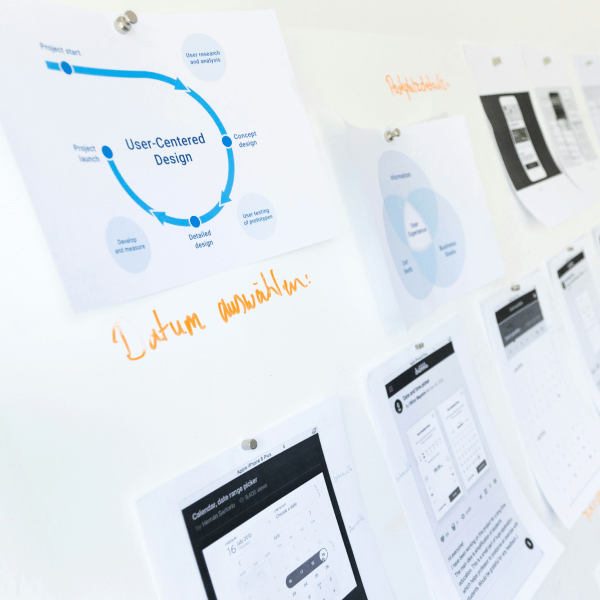

About Interest

Personal Loans

Provide loan amounts ranging from a few thousand dollars to tens of thousands of dollars

Online Loans

High loan amount, able to meet larger financial needs

Tuition Fee Loans

The amount of the loan is determined based on the tuition amount offered by the school.

Loan interest

Fixed rate: The interest rate remains the same throughout the loan period. The benefit of this method is that the monthly repayment amount is fixed, which is easy to budget and plan.

Floating rate: The interest rate may adjust as market conditions change. This type of interest rate is usually lower, but be aware that market fluctuations may affect the repayment amount..

StudenBank provides a variety of loan methods and flexible repayment options, combined with low-interest loan solutions, to provide convenient and efficient financial support for international students. Understanding the detailed information and interest rate policy of the loan can help you better plan your finances and successfully complete your studies.

MARIA STEVENS

Interest Calculation

Equal principal repayment: The monthly repayment principal is fixed, and the interest decreases as the principal decreases. The initial repayment pressure is greater, but the overall interest expenditure is lower.

Additional Fees

Early repayment fees: StudenBank generally does not charge early repayment fees, allowing students to repay early at any time to reduce the total interest expenditure.

Tips

Understand preferential policies: When applying, be sure to ask if there are applicable discounts or offers that can help further reduce the cost of your loan